LEADING THE WAY.

2020 UPDATE.

INDEPENDENT CONTRACTOR STATUS

In September 2019, the California legislature approved a controversial new law that will reshape the way businesses across the state classify workers. The new law will make it much more difficult for many companies to treat workers in California as independent contractors, and more difficult for smaller, entrepreneurial businesses to hire.

Background

The ground started to shift under the feet of many California businesses back in April 2018, when the California Supreme Court issued an unprecedented ruling that undermined its own previous decisions and adopted what is known as the ABC test for determining independent contractor status. Prior to this decision, employers used a flexible multi-factor balancing test to determine whether a worker was a contractor or employee. But under the now infamous Dynamex ruling, a worker is considered an employee under the state Wage Orders unless the hiring entity establishes all three of these prongs:

- 1.the worker is free from the control and direction of the hirer in connection with the performance of the work, both under the contract for the performance of such work and in fact;

- 2.the worker performs work that is outside the usual course of the hiring entity's business;

- 3.and the worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed for the hiring entity.

The decision not only expanded the definition of "employee" under the California Wage Orders, it also imposed an affirmative burden on companies to prove that independent contractors are being properly classified. Questions remained, however, about the scope of the ruling, the applicability of it to various state laws, the retro-activity of the ruling, and various other matters. For much of the past year-and-a-half, California businesses using contract labor were unsure of where they stood.

The state Assembly passed AB 5 in May 2019, and after a few months of final negotiations and deliberations, the state Senate voted to approve a slightly revised measure. The Assembly put the final stamp of approval on the ultimate version of the bill which Governor Newsom promised to sign into effect.

Effective January 1, 2020, businesses, except for those lucky enough to secure an exemption from the state legislature, will have to comply with the ABC test or face a raft of legal problems. While the Dynamex ruling applied only to California's Wage Orders and therefore was limited to minimum wage, overtime, and meal and rest break liability, AB 5 goes several steps beyond. Those workers considered mis-classified under the new state law will also be eligible for workers' compensation coverage, unemployment insurance, various benefits, paid sick days, and state family leave.

Moreover, because hundreds of thousands of workers will now be considered employees, they will automatically be covered by state and federal civil rights laws, including the most common discrimination and harassment protections. Last, but certainly not least, those workers considered employees and not contractors may now have the ability to organize themselves into labor unions, depending on how federal labor law is read in concert with the new state law, which is something that businesses with a contractor workforce have never had to worry about before.

If there is a silver lining, it’s that AB 5 does limit the ABC test to a certain extent and provides an exempted list of workers who are not affected by its reach.

This list includes:

doctors, dentists, and veterinarians;

lawyers, architects, engineers, private investigators, and accountants;

securities broker-dealers and investment advisers;

human resources administrators;

travel agents;

marketers, graphic designers, grant writers, fine artists, certain photographers or photo journalists, and certain freelance writers and editors; and

There are also several classifications of exemptions that carry certain conditions. For example:

Commercial fishermen are exempt from all requirements except from unemployment insurance;

Estheticians, electrologists, manicurists, barbers, and cosmetologists are exempt but only if they set their own rates, are paid directly by clients, schedule their own appointments, and follow several other requirements more akin to independent workers than employees; and

Salespersons are exempt, but their pay must be based on actual sales as opposed to wholesale purchases or referrals.

While it is possible that other exemptions will be carved out of the statute in future legislative sessions, it is time for California businesses to adjust to the new normal and begin AB 5 compliance efforts right away.

Although much of the publicity surrounding AB 5 has focused on businesses that hire independent contractors, the bill's reach is far more extensive. Businesses may find themselves liable to the employees of their vendors, even if those vendors are large, established businesses. This is because a vendor's employees may be able to claim they are also employees of the "contracting business" under the ABC test unless the contracting business can satisfy 12 different requirements outlined in the law.

Among those, the business retaining a vendor must now prove that any vendor they hire actually provides the same or similar business services to other clients, and the vendor must provide services directly to the business, not to the business's customers. The bill even requires, among other things, that the vendor advertise its services to the public.

Understanding the ABC Test

Part A of the ABC Test

The worker is free from the control and direction of the hirer in connection with the performance of the work, both under the contract for the performance of such work and in fact.

Employers may want to think about how much control they have over the worker?

- Little control = Independent Contractor classification might be OK.

- A lot of control = Independent Contractor classification is likely problematic.

Part B of the ABC Test

The worker performs work that is outside the usual course of the hiring entity’s business.

- Employees typically perform services that are integrated into an employer’s operations. (e.g., a plumber for a plumbing company)

- Independent Contractor’s perform ancillary services that are central to their business, not that of the employer. (e.g., a plumber providing services to an architectural consulting company).

Part C of the ABC Test

The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed for the hiring entity.

- Worker must have taken steps to create independent business, making the decision on their own without collusion.

- Although a business does not necessarily have to prove that workers in question took steps such as incorporation, licensure, advertising, and the like to prove this prong, it is definitely recommended.

The Independent Contractor must pass ALL criteria of the ABC test in order to be classified as an Independent Contractor. For example, if they meet the B and C prong but not the A, then the Independent Contractor most likely would be considered an employee.

What Next?

This new law represents a shift for California independent contractor law and businesses. Those doing business in the state must now carefully analyze their relationships with their business vendors to ensure compliance. Misclassification of such workers can result in significant legal exposure when it comes to wage and hour liability, benefits coverage, workers' compensation laws, unemployment compensation, and a whole host of other legal issues.

Further, those who will soon be categorized as employees will be entitled to protection under state and federal civil rights laws, including those barring discrimination, harassment, and retaliation. Finally, they may be entitled to form into labor unions, depending on how federal labor law is interpreted, which means that organized labor will be eager to capitalize on the new wave of eligible workers who could be added to their ranks. Expect to see organizing drives increase in California in the early part of 2020 and beyond.

All businesses that retain contract labor and do not fall into the above exemptions will need to make some tough decisions. Should you restructure your operations to ensure you are on the right side of the ABC test, or should you restructure your working relationships to classify your workers as employees? Each decision carries with it a number of technical and legal issues that can only be dealt with on a business-by-business basis; there is no one-size-fits-all answer.

MINIMUM WAGE INCREASES

State by State

MINIMUM WAGE INCREASES

State by State

Under the Fair Labor Standards Act (FLSA), the federal minimum wage hasn’t changed, since July 2009, when an amendment brought the rate to $7.25 per hour. However, this hasn’t stopped our states and other local areas from establishing their own minimums, most of which are changing annually. In 2020, numerous state and local area minimums will be increasing.

The following minimums will be effective January 1, 2020, unless otherwise indicated.

Alabama: $7.25

Alaska: $10.19

Arizona: $12.00

· Flagstaff: $13.00

Arkansas: $9.25

California: $12.00 for small companies with 25 employees or less; $13.00 for companies with more than 25 employees.

· Alameda: $13.50 (This will increase to $15.00 on July 1st.)

· Belmont: $15.00

· Berkeley: $15.59 (This will increase on July 1st – rate TBD.)

· Cupertino: $15.35

· Daly City: $13.75

· El Cerrito: $15.37 (This will increase on January 1st – rate TBD.)

· Emeryville: $15.00 for small companies with 55 employees or less; $16.30 for companies with more than 55 employees (This will increase on July 1st – rate TBD.)

· Fremont: $11.00 (to $13.50 on July 1st) for companies with 25 or fewer employees; $13.50 (to $15.00 on July 1st) for companies with 26 or more employees

· Los Altos: $15.40

· Los Angeles City: $13.25 (to $14.25 on July 1st) for small companies with 25 employees or less; $14.25 (to $15.00 on July 1st) for companies with more than 25 employees

· Los Angeles County (unincorporated areas): $13.25 (to $14.25 on July 1st) for small companies with 25 employees or less; $14.25 (to $15.00 on July 1st) for companies with more than 25 employees

· Malibu: $13.25 (to $14.25 on July 1st) for small companies with 25 employees or less; $14.25 (to $15.00 on July 1st) for companies with more than 25 employees

· Milpitas: $15.00 (This will increase on July 1st – rate TBD.)

· Mountain View: $16.05

· Oakland: $14.14

· Palo Alto: $15.40

· Pasadena: $13.25 (to 14.25 on July 1st) for small companies with 25 employees or less; $14.25 (to 15.00 on July 1st) for companies with more than 25 employees

· Redwood: $15.38

· Richmond: $15.00

· San Diego: $13.00

· San Francisco: $15.59 (This will increase on July 1st – rate TBD.)

· San Jose: $15.25

· San Leandro: $14.00 (This will increase to $15.00 on July 1st)

· San Mateo: $15.38

· Santa Clara: $15.40

· Santa Monica: $13.25 (to $14.25 on July 1st) for small companies with 25 employees or less; $14.25 (to $15.00 on July 1st) for companies with more than 25 employees

· Sunnyvale: $16.05

Colorado: $12.00

Connecticut: $11.00 (This will increase to $12.00 on September 1st.)

Delaware: $9.25

Florida: $8.56

Georgia: $7.25

Hawaii: $10.10

Idaho: $7.25

Illinois: $9.25 (This will increase to $10.00 on July 1st.)

· Chicago: $13.00 (This will increase on July 1st – rate TBD.)

· Cook County (outside of Chicago): $12.00 (This will increase to $13.00 on July 1st)

Indiana: $7.25

Iowa: $7.25

Kansas: $7.25

Kentucky: $7.25

Louisiana: $7.25

Maine: $12.00

· Portland: $11.11 (This will increase on July 1st – rate TBD.)

Maryland: $11.00

· Montgomery County: $12.50 (to $13.00 on July 1st) for small companies with 50 employees or less; $13.00 (to $14.00 on July 1st) for companies with more than 50 employees

· Prince George’s County: $11.50

Massachusetts: $12.75

Michigan: $9.65

Minnesota: $8.15 for small companies with annual gross revenue less than $500k; $10.00 for large companies with annual gross revenue of $500k or more

· Minneapolis: $11.00 (to $11.75 on July 1st) for small companies with 100 employees or less; $12.25 (to $13.25 on July 1st) for companies with more than 100 employees

Mississippi: $7.25

Missouri: $9.45

Montana: $8.65

Nebraska: $9.00

Nevada: $7.25 for employees who receive qualifying health benefits, $8.25 for employees who do not receive qualifying health benefits

New Hampshire: $7.25

New Jersey: $11.00

New Mexico: $9.00

· Albuquerque: $8.35 for employees who receive qualifying health benefits, $9.35 for employees who do not receive qualifying health benefits

· Bernalillo County (outside of Albuquerque): $9.05

· Las Cruces: $10.25

· Santa Fe City & County: $11.80 (This will increase on March 1st – rate TBD.)

New York: $11.80 (December 31st, 2019)

· Fast Food Companies (outside of New York City): $13.75 (December 31st, 2019)

· Nassau, Suffolk and Westchester Counties: $13.00 (December 31st, 2019)

· New York City: $15.00 (December 31st, 2019) for companies with 10 employees or less; $15.00 for companies with more than 10 employees

· New York City – Fast Food Companies: $15.00

North Carolina: $7.25

North Dakota: $7.25

Ohio: $7.25 for small companies with annual gross revenue less than $314k; $8.70 for large companies with annual gross revenue of $314k or more

Oklahoma: $7.25

Oregon: $11.00 (This will increase to $11.50 on July 1st.)

· Portland Metro: $12.50 (This will increase to $13.25 on July 1st)

· Standard Counties: $11.25 (This will increase to $12.00 on July 1st)

Pennsylvania: $7.25

Rhode Island: $10.50

South Carolina: $7.25

South Dakota: $9.30

Tennessee: $7.25

Texas: $7.25

Utah: $7.25

Vermont: $10.96

Virginia: $7.25

Washington: $13.50

· SeaTac (Hospitality & Transportation Companies): $16.34 (This will increase on January 1st – rate TBD.)

· Seattle: $13.50 for employees who receive qualifying health benefits in companies with 500 employees or less; $15.75 for employees who do not receive qualifying health benefits in companies with 500 employees or less; $16.39 for companies with more than 500 employees (This will increase on January 1st – rate TBD.)

Washington D.C.: $14.00 (This will increase to $15.00 on July 1st.)

West Virginia: $8.75

Wisconsin: $7.25

Wyoming: $7.25

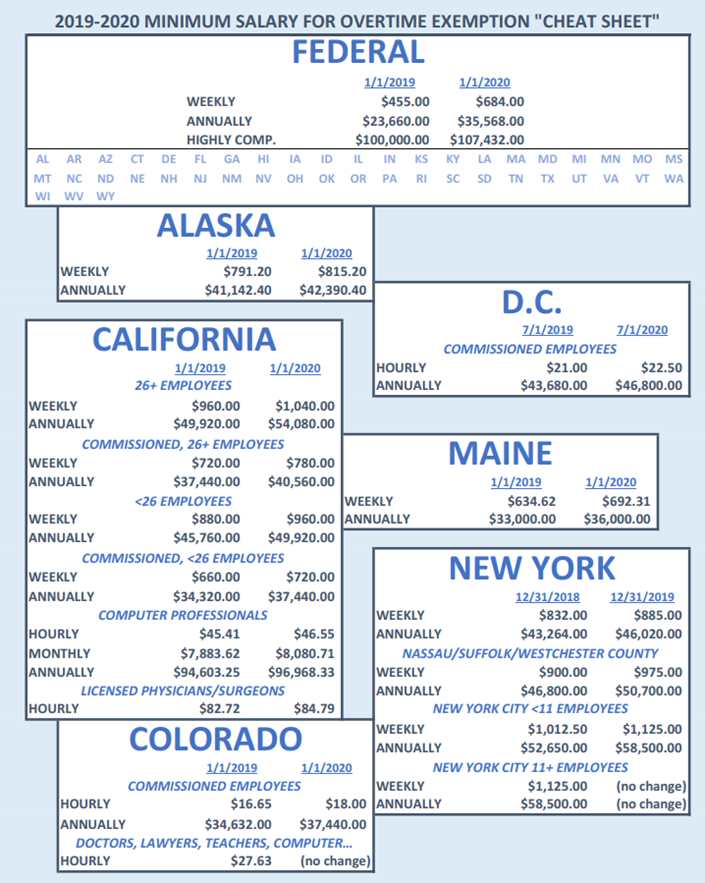

MINIMUM SALARY FOR OVERTIME EXEMPTION

Employment Legislation

California

EMPLOYMENT LEGISLATION

EMPLOYMENT LEGISLATION

California Legislation

There were 2,576 bills introduced and 1,042 made it to the Governor for signature. Only 83.5% of the 1,042 bills were signed into law. The majority of the laws that affect employment will be effective January 1, 2020. Below is a brief summary of key legislations:

ARBITRATION AND SETTLEMENT AGREEMENTS

AB 51 – Waiver as Condition of Employment.

Bans employers from requiring employees or applicants to waive any right, forum or procedure under FEHA or Labor Code as a condition of employment. *As of December 30, 2019, the federal court granted a temporary restraining order to halt the law from being enforced until the request for a preliminary injunction is decided. More information to come.

AB 749 – Settlement Agreements: Restraints in Trade. Prohibits employment settlement agreements from restricting a settling party from working for the employer or any parent, subsidiary, or affiliate (“no rehire” agreements).

HARASSMENT, DISCRIMINATION AND RETALIATION PROTECTIONS

AB 9 – Employment Discrimination Claims. Extends the statute of limitations from 1 year to 3 years for complaints alleging employment discrimination under the Fair Employment and Housing Act (FEHA).

AB 547 – Janitorial Workers: Harassment Prevention Training. Mandates that the Department of Industrial Relations establish a training advisory committee to create a list of qualified organization that janitorial employers can engage to provide sexual harassment prevention training.

SB 530 – Construction Industry, Staffing Agencies, Temporary Workers: Harassment Prevention Training: Delays harassment prevention training until January 1, 2021. For construction industry, instructs the DLSE to develop industry specific harassment prevention policy and training standards.

SB 188 – Racial Discrimination Hairstyles. The CROWN act expands the definition of prohibited racial discrimination, barring employers from banning racially associated hairstyles in dress codes or grooming standards.

SB 778 – Harassment Prevention Training. Amends last year’s SB 1343 to revise the deadline for expanded training requirements of new employees on anti-harassment state law guidelines to January 1, 2021.

BENEFITS AND LEAVES OF ABSENCE

AB 1223 – Living Organ Donation. Requires an employer to provide additional, unpaid leave time, of up to 30 days a year, to an employee who is donating an organ.

AB 1554 – Flexible Spending Accounts: Annual Withdrawal Notice. Requires that employers provide two forms of notice to employees participating in a flexible spending account (including a health savings, dependent care, or adoption assistance account) of upcoming withdrawal deadlines toward the end of a benefit year.

SB 83 – Paid Family Leave. Increases paid family leave from six weeks to eight weeks beginning July 1, 2020.

HEALTH CARE

AB 1695 – Skilled Nursing Facilities: Change of Ownership, Employee Retention. Requires a licensee of a skilled nursing facility to give detailed written notice to residents, at least 90 days in advance, of any sale, transfer of operation, or other change of ownership.

SB 78 – Health Benefit Exchange: Create a Health Benefit Exchange program to subsidize health insurance for individuals earning less than 600% of the federal poverty level, implements an individual mandate penalty, changes labor and workers’ compensation rules to allow state hospital patients participating in a vocational rehabilitation program to be paid the federal minimum wage.

PRIVACY

AB 25 – California Consumer Privacy Act of 2018: Exemption for Employment-Related Information: Exempts from the coverage of the California Consumer Privacy Act of 2018 (CCPA) certain personal information businesses gather from employees or job applicants within the normal scope of employment or hiring. The exemption is scheduled to sunset on January 1, 2021.

AB 874 - California Consumer Privacy Act of 2018: Definitions: Expand the defining of “publicly available” information that is exempted from the CCPA to include information that is made available from government records. Amends the definition of “personal information” that could be “reasonably associated” with a specific individual or household.

AB 1130 – Personal Information: Data Breaches: Revised the definition of personal information in various consumer protection statutes to include biometric data, tax identification numbers and passport numbers.

LACTATION ACCOMMODATION

SB 142 – Obligates employers to provide a private, safe lactation room with a seat, electricity, and a surface, that is not a bathroom and is in proximity to the employee’s work station. Must also provide access to a refrigerator or a cooler and running water near the workplace. Creates undue hardship exemption for certain employers.

WAGE AND HOUR

AB 673 – Failure to pay wages penalties. Authorizes employees seeking wages owed to bring an action either to recover statutory penalties against the employer or to seek to enforce civil penalties under the Private Attorneys General Act (PAGA) – but not both for the same violation.

WORKER CLASSIFICATION

AB 5 – Worker Classification: Applies ABC Test from the Dynamex v. Superior Court case as a way to classify whether employees or independent contractors based on 1) whether the hiring entity controls the work, 2) if the worker does tasks outside the usual course of the hiring entity’s business, AND 3) if the worker performs similar work for other customer.

WORKERS’ COMPENSATION

AB 1804 – Occupational Injuries and Illnesses: Reporting. Requires employers to report serious injury illness, or death immediately through an online mechanism established by the Division of Occupational Safety and Health or to report by telephone.

LEGISLATION IN OTHER STATES

Legislation in other States

The following is a summary of key legislation that has passed, recently.

Illinois

The Workplace Transparency Act (WTA) takes effect January 1, 2020. WTA prohibits the use of non disclosure or non-disparagement agreements that prevent employees from making truthful statements or disclosures about alleged unlawful employment practices.

Amendments to Illinois Human Rights Act take effect on January 1, 2020 requiring employers to comply with new rules that include the prohibition of discrimination or harassment applying to the other locations outside the workplace. Employers will be required to provide mandatory sexual harassment training annually to all employees. Beginning July 1, 2020, employers will be required to disclose annually any adverse judgement or administrative ruling relating to unlawful harassment or discrimination against the employer in the preceding calendar year.

SB 1557 -Cannabis Regulation and Tax Act (CRTA) effective January 1, 2020 permits the use of recreational cannabis for adults 21 years of age or older. However, the CRTA allows employers to implement zero tolerance policies in the workplace and at times when employees are on-call, to prohibit the possession or use of cannabis in the workplace.

Amendments to Victims’ Economic Security and Safety Act (VESSA) effective January 1, 2020 will allow unpaid protected leave to certain employees who are victims of gender violence.

Chicago – Predictable scheduling law, effective July 1, 2020 requires employers (100+ employees globally) to notify low-income workers (earning less than $26/hour and salaried workers earning less than $50K/annually) of changes to their schedules 10 days in advance and applies to a wide variety of industries.

Minnesota

Duluth, Minnesota enacts Paid Sick Leave Law effective January 1, 2020. Employers of 5 or more employees must provide paid sick and safe leave to employees.

Minneapolis, Minnesota passed Wage Theft Prevention Ordinance effective January 1, 2020 – Employees who work at least 80 hours per year within city limits must adhere to the Ordinance. The Ordinance mirrors Minnesota law but also contains additional requirements.

Nevada

SB 312 - Paid Leave Law takes effect January 1, 2020. All private employers with 50+ employees in Nevada will have to provide employees with up to 40 hours of paid leave per benefit year.

AB 132 – Unlawful for any Nevada employer to fail or refuse to hire a prospective employee because the prospective employee submitted to a blood, urine, hair or oral fluids drug test and the results of the test revealed the presence of cannabis.

New Mexico

New law forbidding employers from asking applicants about criminal records that have been sealed or expunged becomes effective January 1, 2020.

Bernalillo County, New Mexico amends Employee Wellness Act to require covered employers to provide paid time off (PTO) that employees can use for any reason effective July 1, 2020.

New York

Paid Family Leave - As of January 1, 2020, Paid Family Leave benefits increase to 60% of the employee’s average weekly wage up to a cap of 60% of state Average Weekly Wage.

Harassment Laws - NY state harassment laws updated in 2020 containing significant new obligations for private employers such as, expanding coverage to employers of all sizes; banning contractual agreements between employer and employee that prevent disclosure of factual information related to any future claim of discrimination; and lengthening the statute of limitations for individuals to file a charge with the New York State Division of Human Rights form one year to three years.

Pay Equity - Ban on salary history inquiries effective January 6, 2020. All New York employers will be prohibited form inquiring about the salary history of a job candidate or relying on salary history in determining the wages to offer a prospective employee.

Pre-Employment Drug Testing - Ban on Pre-Employment Marijuana Testing effective May 10, 2020. New York City employers will be prohibited from conducting pre-employment drug testing for THC, the active ingredient in marijuana.

Expansion of the New York City Human Rights Law (NYCHRL) beginning January 11, 2020. The anti-discrimination protections afforded to New York City employees will extend to independent contractors and freelancers.

Modifications to the data breach notification law will become effective on March 21, 2020 affecting the new date security protections.

Ohio

Toledo enacts law that prohibits employers from asking an applicant about his or her salary history. Ordinance will take effect July 4, 2020.

HEALTH CARE REFORM UPDATE

2020

HEALTH CARE 2020 UPDATE

Federal Law Updates: Affordable Care Act

· Employer Mandate provisions are still in effect- Form 1095-Cs will be distributed to employees no later than March 2, 2020.

· Large employers with a January to December measurement period will receive Qualified Variable Employee reports in February 2020. Qualifying employees will need to be offered coverage by April 1, 2020.

· Individual tax penalty for not having health insurance was reduced to $0 in 2019. This applies to the 2020 tax year as well.

California State Law Updates

· New California ACA-Style Individual Mandate- Effective January 1, 2020, California residents must have minimum essential coverage (MEC) or pay a state penalty tax (mirrors prior penalties under the ACA); All providers of MEC must report to Franchise Tax Board (FTB) by March 31 of the year after close of each coverage year (Federal MEC reporting forms 1095-B and 1095-C will suffice).

· Cal Savers Retirement Program applies to employers who do not offer a 401(k) plan. Deadline for registration for eligible employers varies by size.

· FSA “Use it or lose it” Notice – Effective January 1, 2020, two (2) forms of notice regarding deadline to use FSA must be sent to employee before the end of the plan year.

· New Telehealth laws in California are expanded.

· Registered Domestic Partner Updates – Effective January 1, 2020, California eliminates the requirement that at least one member of an opposite-sex partnerships be at least age 62 and eligible for Social Security benefits in order for the couple to register as domestic partners.

TAX UPDATES 2020

TAX UPDATES FOR 2020

- FEDERAL

- FICA (Social Security

- Maximum Taxable Earnings $137,700

($4800 increase from 2019)

- Employer/Employee 2020 Withholding Percent 6.2%

- Employer/Employee 2020 Maximum Withholding $8539.40

($297.60 increase from 2019)

FICA (Medicare)

- Maximum Taxable Earnings No Limit

- Employer/Employee 2019 Withholding Percentage 1.45%

- Employer/Employee 2019 Maximum Withholding No Limit, no change from 2019

Additional Medicare Tax for Wages in Excess of $200,000, Rate 0.9% is required to be deducted by Employers

- SUPPLEMENTAL WAGES

- Rate (flat rate withholding method) 22%

- Over $1 million 37%

- WITHHOLDING

2020 new brackets depending on your income and filing status (see next page)

- 401(k) PLAN DEFERRAL LIMITATIONS:

- Elective Deferrals $19,500

($500 increase from 2019)

- 401K Catch Up Contribution Deferrals $6,500

($500 increase from 2019)

- HSA PLAN DEFERRAL LIMITATIONS

- Individual Maximum Contribution (Includes Employer Contribution) $3,550

($50 increase from 2019)

- Family Maximum Contribution (Includes Employer Contribution) $7,100

($100 increase from 2019)

- Catch Up Contributions (55+ years old) $1,000

(No change from 2019)

- FSA PLAN THRESHOLDS

- Health Max Election $2,750

($50 increase from 2019)

- Dependent Care Max Election $5,000

(No change from 2019)

- TRANSPORTATION THRESHOLDS

- Pre-tax Parking Max Election $270/month

($5 increase from 2019)

- Mass Transit Max Election $270/month

($5 increase from 2019)

2020 Withholding Brackets

For unmarried individuals:

- 10%: Taxable income up to $9,875

- 12%: Income between $9,875 to $40,125

- 22%: Income between $40,125 to $85,525

- 24%: Income between $85,525 to $163,300

- 32%: Income between $163,300 to $207,350

- 35%: Income between $207,350 to $518,400

For heads of household:

- 10%: Taxable income up to $14,100

- 12%: Income between $14,100 to $53,700

- 22%: Income between $53,700 to $85,500

- 24%: Income between $85,500 to $163,300

- 32%: Income between $163,300 to $207,350

- 35%: Income between $207,350 to $518,400

- 37%: Income over $518,400

For married individuals filing jointly:

- 10%: Taxable income up to $19,750

- 12%: Income between $19,750 to $80,250

- 22%:Income between $80,250 to $171,050

- 24%: Income between $171,050 to $326,600

- 32%: Income between $326,600 to $414,700

- 35%: Income between $414,700 to $622,050

- 37%: Income over $622,050

For married individuals filing separately:

- 10%: Taxable income up to $9,875

- 12%: Income between $9,875 to $40,125

- 22%; Income between $40,125 to $85,525

- 24%: Income between $85,525 to $163,300

- 32%: Income between $163,300 to $207,350

- 35%: Income between $207,350 to $311,025

- 37%: Income over $311,025

Need help navigating your HR?

This information is intended to provide an overview of some important employment law updates within the United States. It is not intended to be an exhausted list of legislation and/or legal advice for any specific situation or set of facts. Whenever you are dealing with any employment-related situation it is always a good idea to seek the advice of a ModernHR Human Resources Representative or competent legal counsel.